Cost basis per share calculator

Enter the number of shares and price per share for the first purchase and second purchase below. If tax status 2 enter fair.

Stock Average Calculator Cost Basis

The Cost Basis Calculator automatically calculates the cost basis and number of shares held for requested securities.

. It covers complex factors like mergers spin-offs voluntary events and. 40 shares costing 18 per share. The total total cost basis for the 15 shares sold would be 10 x 120 5 x 100 or 1700.

Cost basis allocation factor for security 2. Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts. Cost basis per share is the amount you paid for each share after accounting for factors such as dividend reinvestment investment fees and stock splits.

Lets suppose today AMD stock climbed to 100 USD per share. Download Average Down Calculator as an Excel File for free. Then Stock profit 100 USD -.

For example if you own three shares in the Stock Basis Calculator app and. How to calculate your cost basis and access cost basis worksheets Using your own records first determine the date you acquired your shares and the cost per share at that. Indicate original cost basis per ATT share.

Computershare Microsofts transfer agent administers a direct stock purchase plan and a divident reinvestment plan for the company. If you acquired your ATT Inc. CALCULATOR FOR STOCK SPINOFFS.

If you refer to the FIFO section above the same sale of 15 shares resulted in a cost. Multi-merger exchange ratio for security 2 number of shares received for each original share Tax status of security 2. Here is the formula.

Percent allocation of cost basis to original stock for example 8. Percent allocation of cost basis to new spinoff stock for example 2 for 20 7. Shares prior to March 20 1998 date of last stock split or through a previous acquisition or merger transaction determining your cost basis is a TWO-STEP.

To find out more about these programs you may. To calculate the cost of multiple shares purchased simply add the individual cost basis for each share you own. To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858.

If you acquired Verizon. Stock profit Current stock price - Cost basis n. Select December 31 1983 as your acquisition date.

Average Cost Calculator for Stocks Cost Basis Calculator The average cost formula is the same if you buy one lot of shares or 20. The cost basis needs to be calculated for each company.

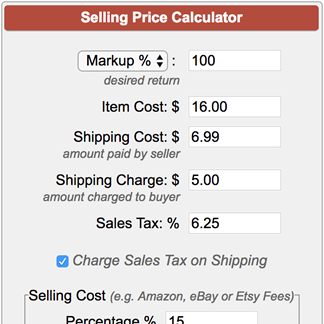

Selling Price Calculator

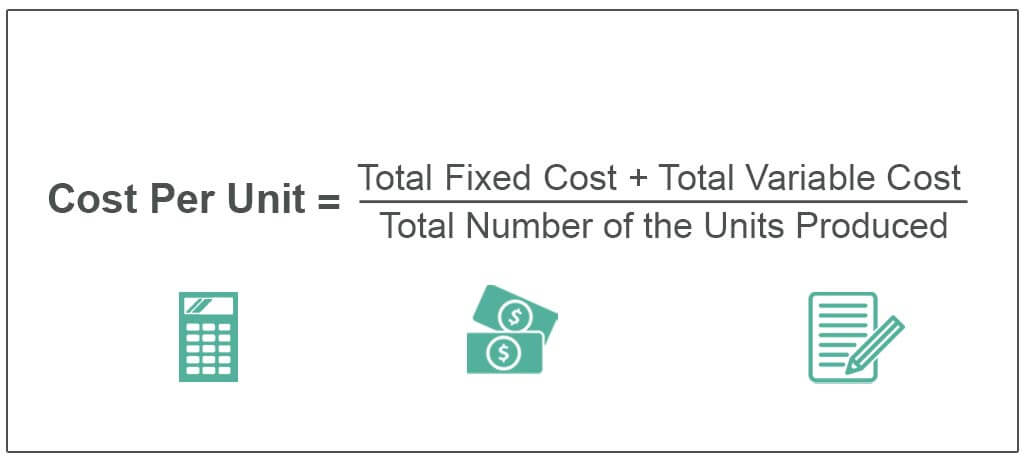

Cost Per Unit Definition Examples How To Calculate

Cost Basis Calculator

Cash Flow Per Share Formula Example How To Calculate

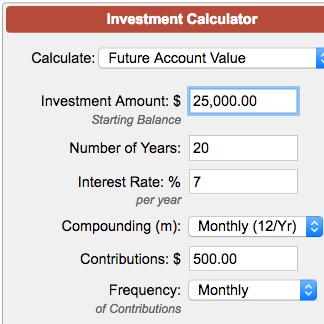

Investment Calculator

How To Calculate Cost Base Per Share

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

Basic Earnings Per Share Eps Formula And Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

Basic Earnings Per Share Eps Formula And Calculator Excel Template

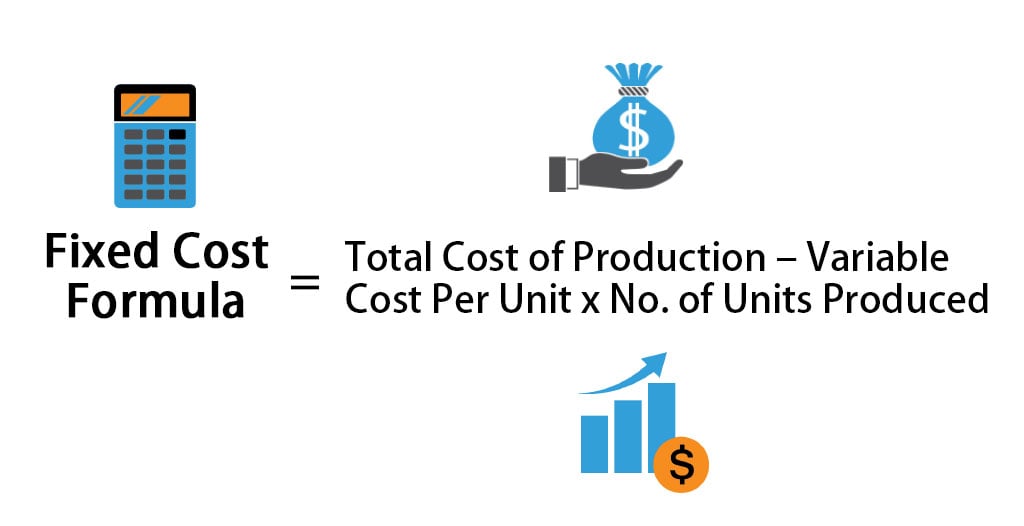

Fixed Cost Formula Calculator Examples With Excel Template

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Stock Average Calculator Cost Basis

Future Value Of An Ordinary Annuity Mgt680 Lecture In Hindi Urdu 25

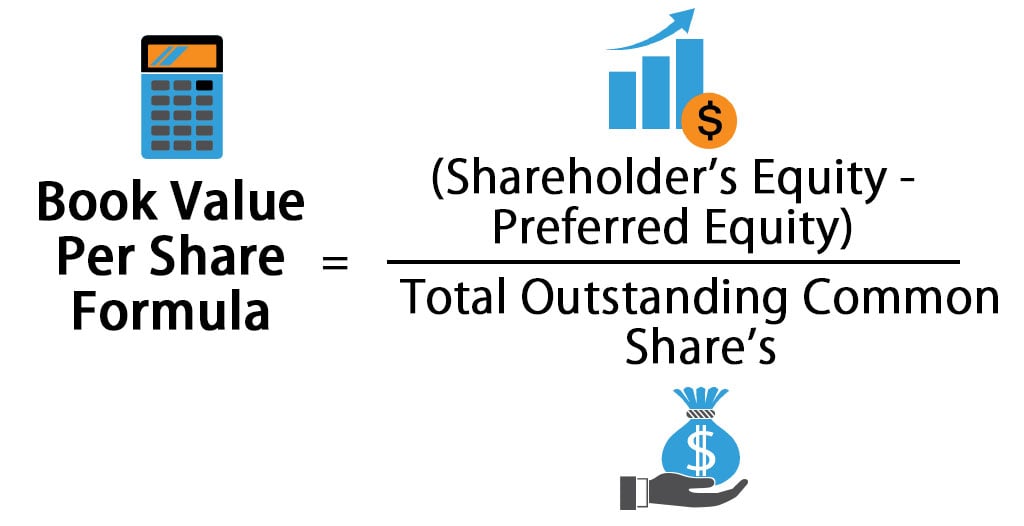

Book Value Per Share Formula Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

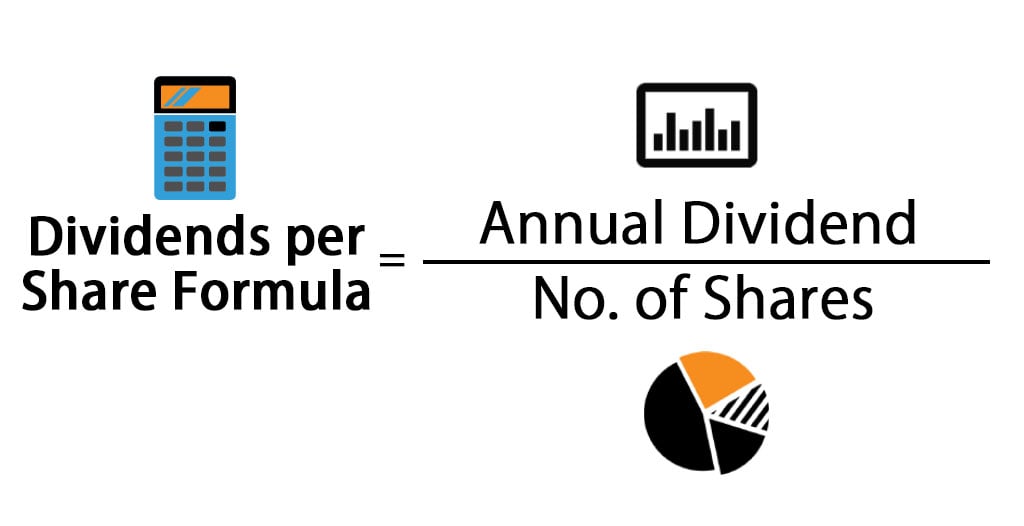

Dividends Per Share Formula Calculator Excel Template